L’atteinte d’un tel objectif requiert le développement d’outils, de méthodes et d’instruments garantissant l’innovation, la qualité et la disponibilité du service ainsi que la rentabilité des activités et des investissements.

C’est dans cette perspective que s’inscrit notre site internet dont la vitalité et la découverte des rubriques vous feront opérer un tour d’horizon de nos missions, de nos valeurs, de nos métiers et de notre organisation interne.

C’est également l’occasion de vous familiariser avec notre stratégie, les services que nous proposons, notre performance à travers nos rapports d’activités ainsi que notre actualité économique et financière.

N’hésitez pas à nous communiquer vos avis, vos demandes particulières, vos attentes…

Bonne navigation.

Marius Issa NKORI

ADG de la Caisse des Dépôts et Consignations

Institution financière, créée sous la forme d’un établissement public à caractère industriel et commercial (EPIC) ;

Entité Publique de droit privé ;

Une Gouvernance assurée par un Conseil d’administration ;

Ce statut juridique donne de l’agilité pour :

La CDC jouit d’une autonomie de gestion administrative et financière tout en étant placée sous la tutelle du Ministère en charge de l’Économie.

Accroître et démultiplier l’action publique ;

Répondre aux enjeux économiques et sociaux de l’Etat ;

Soutenir les politiques publiques en finançant les besoins structurants et les priorités nationales, notamment la mission première de mobilisation de l’épargne et sa sécurisation ;

Transformer les dépôts en emplois productifs, en exerçant les métiers d’investisseur et de prêteur de long terme ;

Contribuer à la diversification de l’économie en intervenant dans les stratégies et des plans de développement des politiques publiques ;

Disposer d’un investisseur qui puisse être précurseur dans des secteurs d’activités porteurs, nouveaux ou peu mâtures, à encourager mais qui n’attirent pas encore les investisseurs privés ;

Enfin, en tant qu’institution publique de financement du développement, elle est le premier investisseur de long terme capable de prendre en charge des investissements structurants d’intérêt général ou collectif et économiquement viables.

Gestion des dépôts et fonds alloués aux institutionnels (dotations et ressources affectées des régies de recette et d’avance, des projets et programmes publics, des administrations, entreprises et établissements publics etc.) ;

Tenue des comptes des institutionnels et des professionnels du droit et autres professionnels agissant en qualité de séquestre ;

Protection de l’épargne règlementée et des fonds de tiers détenus par les professionnels d droit, les fonds admis en consignation, l’épargne populaire des caisses de retraite et les avoir des épargnants sur livret ;

La Caisse des Dépôts est un nouveau type d’investisseur public, investi des missions d’intérêt général en appui aux politiques publiques conduites par l’Etat et les collectivités locales en matière de développement. Elle est un investisseur institutionnel et un prêteur de long terme ;

Pour remplir cette mission, la CDC a besoin de disposer de davantage de ressources longues qui lui permettent de devenir un soutien financier de référence en matière de promotion et d’acquisition immobilière, en matière de financement des infrastructures, ainsi que le financement au meilleur coût, du logement social et de l’aménagement du territoire.

Une Caisse de dépôt doit disposer de ressources abondantes et longues, pour lui permettre de jouer efficacement son rôle d’investisseur de long terme et de soutenir efficacement les politiques publiques ;

Le modèle économique CDC repose sur la structure d’un passif long permettant de s’affranchir des contraintes de l’accès à la liquidité ou de la volatilité des actifs, ce qui implique :

Le modèle financier répond à l’exigence d’allouer de manière optimale les ressources du passif en fonction de leur maturité vers des emplois à maturité correspondante, selon l’orthodoxie d’usage ;

Cette allocation optimale des ressources permet de maximiser les rendements ;

En tant qu’institution de développement se devant de financer le long terme, il va de soi que le volume des ressources longues doit primer significativement sur celles de court terme, et la CDC vient justement d’inverser la structure de son bilan : les ressources à long terme qui ne représentaient en 2012 que 30% du total des ressources, représente désormais 52% du Total Bilan.

Affirmer notre rôle dans la dynamisation de la politique financière de l’Etat, d’investisseur et de prêteur de long terme ;

Renforcer l’assise financière ;

Sécuriser les investissements et renforcer la confiance de la clientèle ;

Se positionner sur les secteurs identifiés comme stratégiques, porteurs et prioritaires ;

Assurer le financement des secteurs prioritaires notamment le logement social et les PME/PMI ;

Assurer la gestion des mandats confiés par l’Etat (infrastructures, environnement, etc.) ;

Adapter en permanence les modes d’intervention et les métiers aux enjeux économiques.

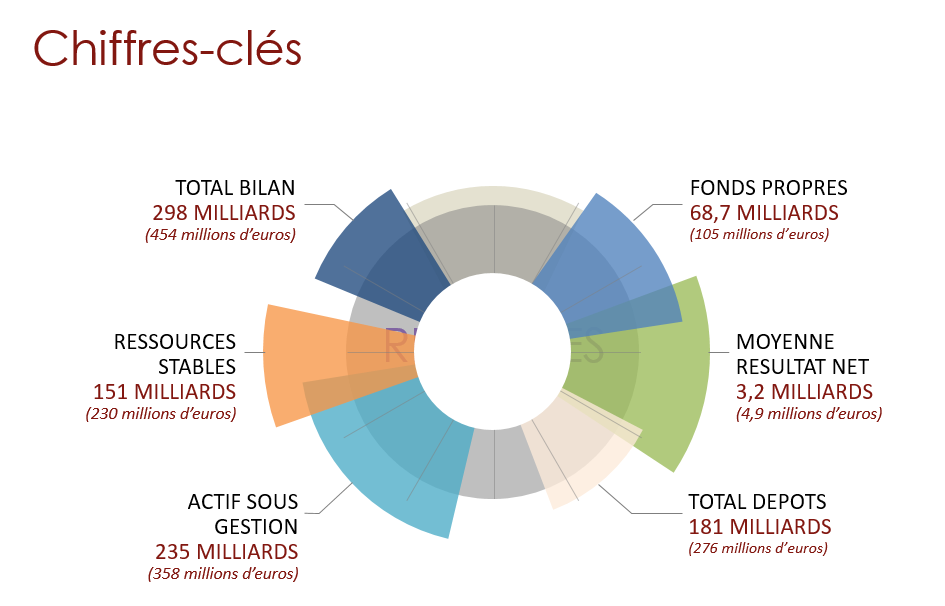

Les chiffres clés de l’exercice 2018 de la Caisse des Dépôts et Consignations se décomposent comme suit :

La Performance est notre credo dans notre démarche de production de la richesse gage de notre prospérité.

CitoyennetéCe leitmotiv qui guide notre action d’accompagnement des politiques publiques en veillant au respect des personnes,des règlements et de l’environnement

ProactivitéLa Proactivité est notre capacité à innover et à impulser des évolutions économiques,sociales et technologiques déterminantes.

SécuritéLa Sécurité est notre aptitude à tenir notre rôle de tiers de confiance de référence.

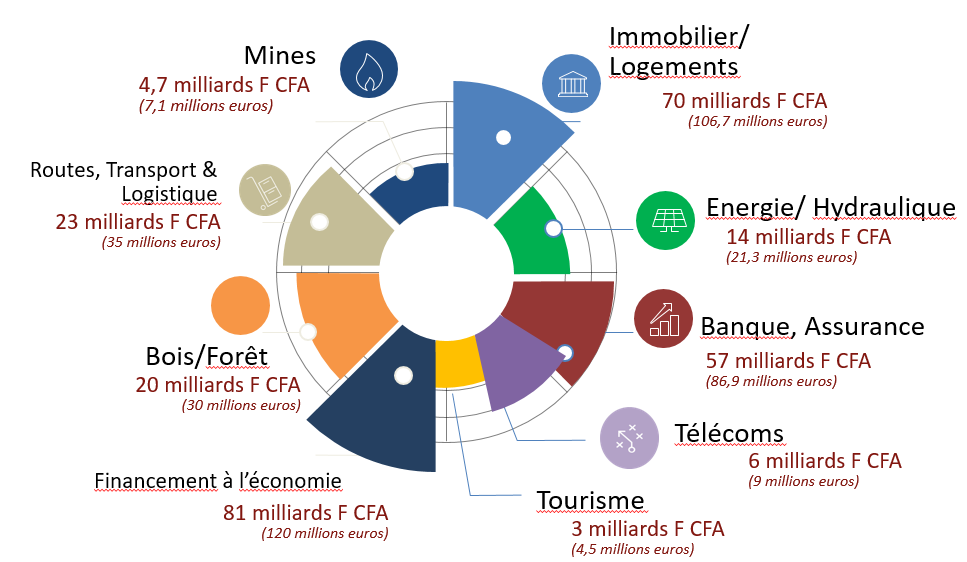

La stratégie d’intervention de la Caisse des Dépôts et Consignations est de se positionner sur les secteurs identifiés comme porteurs et prioritaires, notamment le logement et les TPE/PME/PMI d’une part.

Puis d’assurer la gestion des mandats confiés par l’Etat dans les domaines tels qu’infrastructures sociales, énergie, d’autre part.

La Caisse des Dépôts et Consignations est présente dans neuf (9) secteurs d’activité de l’économie nationale.

Les expositions les plus fortes sont observées dans le secteur de l’exploitation et la transformation du bois, à travers : Rougier Afrique International (RAI), Société de Mise en Valeur du Bois (Somivab), SFM Africa, GSEZ.

EXPLOITATION ET TRANSFORMATION DU BOIS

PROMOTION IMMOBILIERE

EXPLOITATION MINIERE

AGROINDUSTRIE

SERVICES FINANCIERS

TELECOMS

ENERGIE

BANQUE / ASSURANCE

Société de gestion de fonds de capital-investissement

Filiale en charge de la promotion immobilière

Investie d’une mission de service public et d’intérêt général, la Caisse des Dépôts et Consignations (CDC) entend affirmer sa vision et ses engagements dans son rôle d’acteur incontournable du développement gabonais et d’accompagnateur des politiques publiques. Forte de son rayonnement local, la CDC se positionne en tant que partenaire privilégié des institutionnels, des professionnels, et des collectivités locales gabonaises.

La Caisse des Dépôts et Consignations (CDC) reste convaincue que la performance économique est étroitement liée au respect de l’environnement et des préoccupations sociales de ses parties prenantes (clients, collaborateurs, partenaires, communautés) et qu’elle se doit de considérer les grands enjeux de nos sociétés, en particulier le réchauffement climatique. Par conséquent, son engagement en matière environnementale et sociale (E&S) est un élément essentiel qui permet de réaliser les objectifs stratégiques et de bâtir une institution innovante, responsable, citoyenne et acteur de développement inclusif et durable en s’appuyant sur ses valeurs cardinales.

Dans une stratégie de croissance durable, la CDC souhaite préserver une activité multisectorielle et diversifiée combinée à une maitrise robuste des risques E&S associés à ses activités d’institution publique. Ainsi la CDC classe la gestion des aspects E&S parmi ses priorités. C’est dans ce cadre qu’elle a mis en place un système de gestion environnementale et sociale (SGES) qui respecte les lois et réglementations gabonaises en la matière, ainsi que les normes et les standards internationaux.

Le périmètre du SGES couvre toutes les activités de la Caisse des Dépôts et Consignations (CDC). Il couvre notamment les opérations liées aux prêts et aux financements que la CDC consent à ses clients. Le périmètre couvert porte sur l’ensemble du cycle de prêt, depuis la mise en relation (prospection) jusqu’à la fin de l’engagement avec le client.

Pour les usagers souhaitant disposer de plus de détails par rapport à la politique de Responsabilité Environnementale et Sociale de la Caisse des Dépôts et Consignations du Gabon, il est mis à disposition un manuel du système de gestion environnementale et sociale : cliquez ici pour télécharger le MSGES